Facts About Loan Payment Calculator Revealed

Wiki Article

Loan Payment Calculator for Beginners

Table of ContentsSome Ideas on Loan Payment Calculator You Need To KnowLoanspq Fundamentals ExplainedThe Main Principles Of Loandepot How Loan Calculator Car can Save You Time, Stress, and Money.10 Simple Techniques For Loan CalculatorGet This Report about Loan AmortizationMore About LoanspqUnknown Facts About Loans For Bad Credit

Personal loans are borrowed money that can be used for huge purchases, debt combination, emergency expenses and far more. These fundings are paid back in regular monthly installations throughout generally two to six years, but it can take longer relying on your circumstances and also exactly how thorough you are with paying.The majority of personal lendings have repaired rate of interest, which implies that your payments will remain the very same on a monthly basis. Individual car loans are likewise normally unsafe, implying there's no collateral behind the funding. If you do not receive an unprotected personal funding, you might need to make use of collateral to be accepted, like a financial savings account or certificate of deposit.

The Basic Principles Of Loan

9 reasons to obtain a personal finance, While it's always essential to very carefully consider your financial situation before tackling a lending, in some cases an individual funding is the ideal method to fund a big purchase or task that you can not pay for in advance. Below are the leading 9 factors to get a personal funding.Financial obligation consolidationFinancial debt consolidation is among one of the most typical reasons for securing a personal car loan. When you get a funding as well as use it to repay several various other car loans or credit scores cards, you're integrating all of those outstanding balances into one month-to-month settlement. This collection of financial debt makes it simpler to exercise a time framework to repay your equilibriums without getting overwhelmed.

The Main Principles Of Loan Amortization

With reduced prices, you can minimize the amount of interest you pay and also the quantity of time it takes to pay off the debt. Debt consolidation permits you to settle charge card in limited terms with a clear end date visible. Those with several sources of high-interest financial debt. Making use of an individual car loan to pay off high-interest financial debt, like bank card financial debt, allows you to consolidate numerous payments into a single payment with a lower rates of interest.This fast turn-around time commonly makes it hard for debtors to pay back the financing by the due day. Consumers are typically required to renew the finance rather, triggering the accumulated rate of interest to be added to the principal. This increases the total passion owed (loan calculator car). Individual loans have longer term lengths and will typically cost the borrower much less in total passion.

Loan Payment Calculator Can Be Fun For Everyone

Everything about Loan Payment Calculator

Those starting a long-distance relocation as well as expecting thousands of bucks in costs. If you can't quickly manage every one of the expenditures related to a long-distance action, an individual financing can aid you cover those prices. 5. Emergency situation expenses, If you have a sudden emergency situation, like paying for a loved one's funeral service, making use of a personal loan could be a low-priced choice.

The smart Trick of Loandepot That Nobody is Talking About

A personal finance can aid you obtain new devices as quickly as you require them. 7. Vehicle financing, A personal funding is one method to cover the cost of an automobile, watercraft, RV or even personal jet. It's additionally one method to pay for a car if you're denying it from the company directly.Obviously, you must always evaluate the benefits with the disadvantages. Nevertheless, tackling an individual car loan suggests taking on debt, and also you'll need to be prepared to make repayments on that financial debt for a couple of years. If you don't have the regular monthly spending plan for major payments plus rate of interest, reevaluate the amount you require to obtain or the means in which you borrow.

Loancare for Beginners

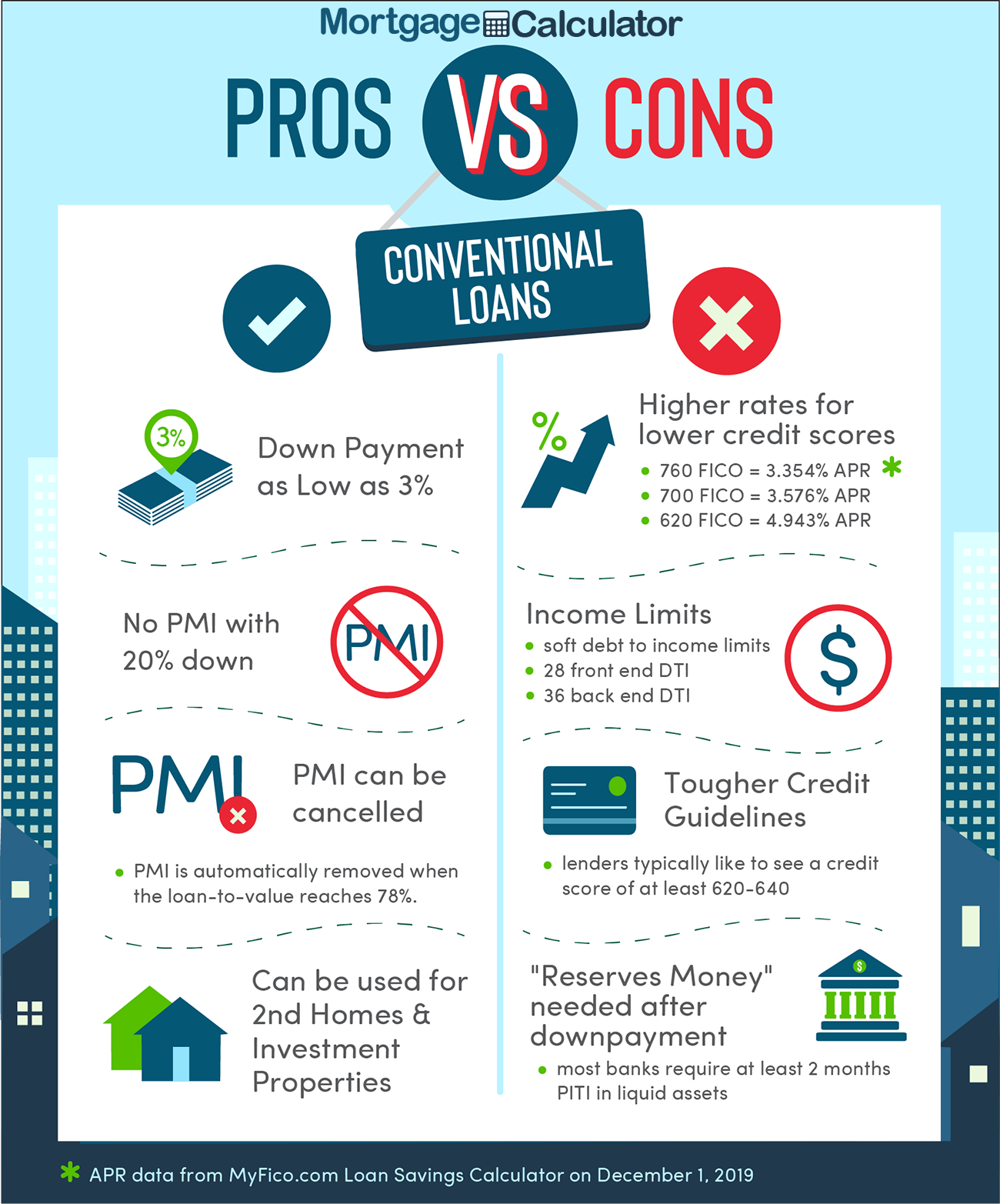

Before applying, consider your monetary situation and the you could check here reason for taking out the finance. "People for whom a personal finance would not make good sense would consist of any person with reasonable or below credit report that might undergo a very high rate of interest price," states Lauren Anastasio, CFP at So, Fi. The lower your credit history, the greater your rates of interest might be.Why choose an individual funding over various other kinds of lendings? Whatever your funding function, you'll likely have numerous options offered to you.

The Main Principles Of Loanadministration Login

Beginning with your present financial institution and after that apply with on-line lenders, neighborhood loan applications credit unions as well as various other financial institutions. Many lenders will enable you to get prequalified, allowing you see your potential rate of interest rates and terms before you apply, all without a difficult inquiry on your credit score report. In addition to rates of interest, you ought to likewise contrast lending terms and fees.

This will certainly result in a difficult query on your credit rating record. For most lenders, this part of the process fasts; as long as you submit all pertinent papers, you may be able to obtain your funds in a matter of days. Obtain pre-qualified Response a few inquiries to see which personal lendings you pre-qualify for.

Report this wiki page